Israel AV Mobility Newsletter | June 2021

Truly global deployment of autonomous driving value chain is presented in Israel, while core tech being exported globally, OEMs choose to deploy their AVPs in Israel. Chinese NIO will be the first autonomous taxi fleet in Israel, join forces with Mobileye to provide the VDS and operate the RoboTaxi service. Though full autonomous commercial fleet is expected to hit the roads of Tel Aviv only at 2023, so in the meanwhile AutoBrains (previously Cartica) announced a collaboration with Continental focused on ADAS applications (driving assistance only), with a roadmap for more advanced levels. It is interesting to see the various development approach for Autonomy, some companies are working from lower levels and grow gradually (e.g. Tesla) and some focus on L4+ autonomous directly (e.g. Waymo). Who do you think will get to the finish line first?

June 1st: Israeli chipmaker Hailo (היילו)partners with Taiwan-based electronics manufacturer, Lanner Electronics to launch AI inference solutions for real-time computer vision. Hailo has combined its Hailo-8 AI acceleration module with Lanner’s computing boxes to create compact devices to support the demand of emerging AI edge applications. This announcement arrived only one week after Hailo-8’s won ‘Best Edge AI Processor’ at the 2021 Edge AI and Vision Product of the Year Awards.

June 1st: Israel’s Ministry of Transport and Kavim bus company launch Israel’s first rural ridesharing bus service ‘Quicker’. After Jerusalem, Tel Aviv, and Haifa, now Northern Lev Hasharon and Emek Hefer residents can also enjoy shared public transport service. Users will be able to book their bus trips when and where it is convenient for them, through the Moovit app, which will calculate the fastest and most cost effective route for users’, from pickup point to destination.

June 7th: Provider of fully automated parking solutions U-tron (יוטרון) expends its activity in the US and will construct an autonomous parking lot in Colorado. The total expected return for the company is NIS 10 million (~USD 3.2 million). This is the 23rd agreement signed by U-tron for the construction of autonomous parking lots in North America and the second agreement in the state of Colorado. U-tron, owned by Israeli private equity firm FIMI (פימי), operates in North America in six major areas: New-York, San Francisco, Los Angeles, Boston, Houston, and Colorado.

June 7th: In-cabin automotive solutions provider Cipia Vision (סיפיה) and US-based IT solutions company Intcomex, partner to provide driver monitoring solutions for commercial fleets. As part of the collaboration, Intcomex will sell Cipia-FS10 device to their fleet customers in Latin America and The Caribbean. The devices will be installed in commercial vehicles and integrated with the fleets existing fleet management system (FMS).

June 9th: Foresight Autonomous Holdings Ltd. (פורסייט אוטונומס הולדינגס בע”מ) announced the sale of its four-camera vision system QuadSight® prototype to a global manufacturer of agricultural and construction equipment. The manufacturer will evaluate Foresight’s stereo capabilities for use in agricultural machinery, including automated navigation, planting, harvesting, and loading crops for shipment, in all weather conditions. This is a first prototype sale to the agricultural equipment market.

June 11th: Israeli AI Startup AutoBrains (אוטובריינס טכנולוגיות בע״מ), partners with tier 1 supplier Continental to bring unsupervised AI technology to ADAS and autonomous application. Unsupervised AI operates in a fundamentally different way from traditional deep learning systems currently used in ADAS and is based on multi-disciplinary R&D that allows the system to independently learn, process, and interpret relevant data from the car’s surroundings in real time.

June 13th: 1 month after reporting a successful testing of its hydrogen-fueled engine, Internal combustion engine developer Aquarius Engines (אקווריוס אנג’ינס), has signed an MOU with energy company Kampac International PLC (KIP) to set up a UDS 1 billion engine manufacturing plant in the UAE. The factory will be constructed and run by a JV: Aquarius Automotive Middle East, which will manufacture products for the automotive industry. As part of the MOU, KIP has been given an option to buy 10% of the shares in Aquarius Engines itself, at a company valuation of USD 5 billion.

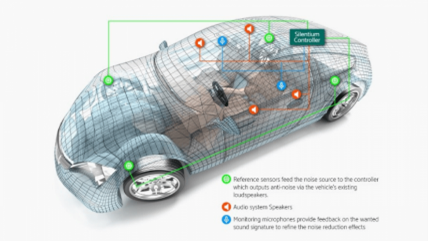

June 15th: Developer of active noise-control technology Silentium (סילנטיום), raised USD 20 million in an extended series D round. The extended round was led by Menora Mivtachim and Meitav Dash. Following the new investment, the company plan to scale up the development and roll-out of its active acoustics software solutions. Silentium has raised approximately USD 63 million to date from Molex, Heliant Ventures and iVentures Asia.

June 17th: Bank Leumi investment unit, Leumi Partners (לאומי פרטנרס) and YSB (קבוצת י.ש. האחים יעקובי בע”מ) partner to promote smart transportation. As part of the agreement, Leumi Partners will invest NIS 50 million in YSB group and in its subsidiary Ariel Wimasor (אריאל וימאזור). The funds will be used to expand and promote “Falcon” traffic management system on Israeli roads and around the world. The system allows control on metropolis traffic by connecting to any controller and sensor on the road by using standard protocols.

June 23rd: Israeli chipmaker Hailo (היילו) is completing a USD100 million round C financing at USD1 billion valuation. The round was led by Zohar Zisapel, OurCrowd, and Delek Automotive Systems. Hailo recently began mass production of its Hailo-8 processor for autonomous cars and other advanced products.

June 24th: NIO cars arriving in Israel for Mobileye’s autonomous taxi trials in Gush Dan area. The first shipment of NIO’s ES8 electric SUV is expected to land in Israel soon to begin trials next year. In the first phase of the trial, the vehicles will be tested on Tel Aviv roads in a total length of about 15 km between Ibn Gabirol and Hayarkon streets, with no passengers. In the advanced development phase, the length of the test roads will be extended to 33 km and will include sections of Ayalon highway and routes at southern Tel Aviv. The pre-commercialization phase will be carried out on a total road area of 111 km and will encompass most of the busiest public transportation lanes in Tel Aviv and its surroundings. The commercial phase with paid passengers is targeted to take place only in 2023. Long after competitors in China and US that have launched similar services earlier this year.

June 24th: Autonomous system simulation software developer Cognata (קוגנטה), partners with Canadian AV and ADAS solutions provider LeddarTech to accelerate testing and validation of self-driving agriculture vehicles. Cognata’s simulation authoring software will be integrated with the LeddarVision sensor fusion and perception technology. The combined technology will aim to offer end users an improved and robust testing and validation environment and perception solution, elevating the user experience with nearly real scenes. Last July, LeddarTech acquired Israeli AV startup VayaVision.

Cognata also announced its collaboration with German Tier1 ZF Friedrichshafen AG to introduce a new scalable suite of Data and AI based services for ADAS Virtual Engineering and Digital Validation called ADAS.ai. The ADAS.ai is designed to help OEMs accelerate the development of ADAS applications for passenger cars and commercial vehicles, and provide significant cost and quality advantages compared to traditional engineering and validation based on physical test drives. ZF been active in Israel lately, this May Mobileye announced it will jointly develop advanced safety systems for Toyota Motor Corp vehicles with ZF.

June 28th: Israeli chipmaker Valens Semiconductor (ואלנס), collaborates with Sony Semiconductor Solutions Corporation (Sony) to develop and integrate MIPI A-PHY technology into Sony’s image sensor products. A-PHY is a long-reach serializer-deserializer (SerDes) physical layer interface for long-reach, ultra-high-speed automotive applications. Valens will be the first company to market with A-PHY compliant chipsets, having recently completed a successful tapeout of its VA7000 chipset family. This collaboration arrives a month after Valens announced a US SPAC merger at a USD 1.16 billion valuation.

June 29th: Israeli-founded DevOps platform company JFrog ג’יי פרוג)) acquires Israeli AI-based IoT and connected device security company Vdoo (וידו) for USD 300 million. Jfrog aims to expand its presence and expertise in the security area, that has become increasingly connected to DevOps. JFrog is publicly traded on Nasdaq since last September, and currently it has a market cap of USD 4.65 billion. Vdoo’s platform is used to detect and fix vulnerabilities in software systems of IoT and connected devices. It previously raised $70 million from several investors. JFrog stated that Vdoo will continue to operate as a standalone SaaS product for the time being, with a goal to have a fully integrated “holistic” product by 2022.

Sources: CISION PR Newswire, Globes, Funder, PRNewsWire, Global Fleet, BusinessWire, Globes, CISION PR Newswire, CTech, TechTime, TechCrunch.