Israel AV Mobility Newsletter | Sep. 2021

Get used to stop the long chat with taxi drivers, Mobileye is building the fundamentals for RobiTaxi deployment in Europe next year, planning to own all vehicles! The global growth in LiDAR demand led Tower to follow Opsys and Innoviz and enter LiDAR development, though unlike the first, Tower is planning to introduce a sensor based on FMCW technology.

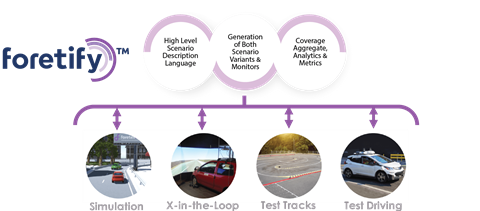

Sep. 1st: Developer of verifying driver assistance and autonomous systems Foretellix (Foretellix Ltd.), completed a $32 million series B funding round. The round was led by MoreTech Ventures, with participation from several strategic investors, including Volvo Group Venture Capital, Nationwide, NI and Japan-Israel High Tech Ventures, and all Foretellix’s series A investors. The new equity will help the company address the growing demand for its platform and products from OEMs and Tier 1s, while develop its products

Sep. 6th: Developer of sensor technology Guardian Optical Technologies (Guardian Optical), was acquired by supplier of electro-optical product for automotive, Gentex Corporation, to expands its cabin monitoring capabilities. The valuation of the deal was not disclosed, but Calcalist estimated that it was completed for $17 million in stock. Guardian has developed a multi-modal sensor technology designed to provide a comprehensive suite of driver and cabin monitoring solutions for the automotive industry. The core technology is based on infrared camera that combines machine vision, depth perception and micro-vibration detection. This proprietary sensor configuration allows the system to not only monitor the driver, but also the entire vehicle cabin and all its objects and occupants, assessing their behavior, gestures, and activities. Gentex is traded on Nasdaq at a $7.4 billion valuation

Sep. 7th: Intel’s subsidiary Mobileye and international provider of mobility services SIXT, partner to launch a new RoboTaxi service in Munich next year. Through the partnership, which was announced during the IAA Mobility show in Germany, riders will be able to access the RoboTaxi service via the Moovit app or through Sixt’s mobility ONE app for ride hailing, vehicle rental, car sharing and car subscriptions. The RoboTaxi fleet will be owned by Mobileye, and SIXT will operate and maintain the vehicles. During the show, Mobileye also unveiled the vehicles branded with MoovitAV and SIXT, which will be equipped with Mobileye’s self-driving system and with Luminar’s series production sensor known as Iris. The service is expected to begin with an early-rider pilot on Munich streets in 2022.

Sep. 8th: Blockchain focused investment fund, Global Blockchain Ventures (GBV) invested $2 million in Israeli developer of SaaS solution for traffic congestion, Mobility Insight (Mobi) to support the company’s expansion into the US. Mobi’s applications provide policy makers, transportation planners and traffic controllers with an advanced intelligent mobility system driven by real-time mobility analytics, prediction/optimization algorithms and AI (Artificial Intelligence) actionable insights. The system enables road authorities to pinpoint future bottlenecks and take preemptive actions that reduce road congestion and harmful carbon emissions. Earlier this year in June, Mobi announced the establishment of Mobility Insight USA, a Florida-based company.

Sep. 9th: Israeli chipmaker Valens Semiconductor (ואלנס) that specialized in the automotive sector, partnered with Chinese integrated optical components and products manufacturer, Sunny Optical to integrate MIPI A-PHY-compliant chipsets into next-generation camera modules. The two companies will work together to integrate the VA70XX transmitter chipsets into Sunny Optical’s camera modules that enable ADAS and surround view applications. The A-PHY is a long-reach serializer-deserializer (SerDes) physical layer interface for multi-gig automotive connectivity, released by the MIPI Alliance in September 2020 as a standard that simplifies the integration of cameras, sensors and displays in vehicles, while also incorporating functional safety and security. The Valens VA7000 chipset family is the first A-PHY compliant chipset and engineering samples will be available in the fourth quarter of 2021.

Sep. 9th: After attempting an IPO a month ago, and lowering initial valuation target of $240 million from January this year, automated drone developer Airobotics (אירובוטיקס) raised NIS 21 million ($6.5 million) from the public through shares at a valuation of NIS 100 million ($31 million) pre-money. The company’s announcement to the Tel Aviv Stock Exchange indicates demand of NIS 24 million in shares, of which Airobotics chose to issue about 3 million shares.

Sep. 13th: Chip and semiconductor manufacturer Tower Semiconductor (טאואר), announced the development of LiDAR IC technology for ADAS and self-driving vehicles. The new IC tech is designed by researchers from the Ming Hsieh Department of Electrical and Computer Engineering (USC) at the Viterbi School of engineering and manufactured using Tower Semiconductor’s open foundry Silicon Photonics platform. This platform offers high-performance elements necessary for high-precision LiDAR applications, such as low-loss silicon nitride waveguides capable of handling larger optical powers. The LiDAR IC is operating at 1550nm wavelength uses Frequency Modulation Continuous Wave (FMCW) technology.

Sep. 14th: Transport optimization platform supplier, Trucknet Enterprise (טראקנט) has signed a €3 million agreement with Danish transport and logistics company DSV. Under the agreement, DSV will deploy Trucknet’s system in its 3,000 Romanian transport companies, expected to generate Trucknet millions of euros in revenue annually. Trucknet already has 5,000 registered customers, mostly operate in France.

Sep. 23rd: Korean corporate LG acquired Israeli cybersecurity company Cybellum Technologies ((סייבלום for $140 million. This is LG’s first acquisition in Israel, buying 64% of Cybellum representing $220 million valuation for the startup. Cybellum’s investors are selling their shares, while founders and employees are retaining the remaining 36%. Under the sale agreement, LG undertook to buy the rest of the shares in Cybellum within three or five years. Cybellum, employs 50 people, of whom 35 are based in Israel, plans to double its workforce after the acquisition.

Sep. 23rd: Haifa-based deep data solutions for advanced electronics provider ProteanTecs, raised additional $50 million in a Growth Equity Round. The round extension was led by Koch Disruptive Technologies (KDT) along with strategic investors Porsche SE, MediaTek, Advantest, Champion Motors and current investors, bringing the company’s total funding to $150 million. ProteanTecs develops a Universal Chip Telemetry™ (UCT) for electronic systems throughout their entire lifecycle. It provides insights and visibility by applying machine learning to novel data created by on-chip UCT Agents™.

Sep. 23rd: Developer of ‘robot-as-a-service’ platform for autonomous systems, Blue White Robotics (BWR) raised $37 million in a Series B round for autonomous farming. The round was co-led by Insight Partners and Entrée Capital, who also took part in the company’s Series A and seed rounds. Follow investors in this round include: Clal Industries, Jesselson Investments, Peregrine VC, Allied Group Investments, and Regah Ventures. Since it was founded in 2017, BWR has raised $50 million.

Sep. 23rd: Robotics AI software startup Cogniteam (קוגניטים) raised $4.2 million. The private investment equity round was led by Seabarn Management’s Founder & CEO, Andrew Owens. Cogniteam has developed an AI cloud-based robot programming and automation system, for the development, maintenance, control and deployment of robots and fleets. The system aims to cut the development time and cost of new robotic applications, which currently stands at approximately six years, by delivering a single program that will consider the full lifecycle of a robot’s development and operation.

Sep. 28th: Developer of verifying driver assistance and autonomous systems Foretellix (Foretellix Ltd.) collaborates with NI (National Instruments) to accelerate test for ADAS and autonomous vehicles. The two companies will deliver new integrated solutions to help engineers get high-quality autonomous driving systems to market faster and at lower development costs, while seamlessly integrating test data and tools across software verification and validation workflow. The collaboration will combine Foretellix’s platform, which delivers scenario generation, with NI’s solution of hardware and software in the loop and ADAS data recording.

Sep. 29th: Israeli chipmaker Valens Semiconductor (Valens) completed a $1.1 billion SPAC merger with PTK Acquisition Corp. (PTK). Valens shares and warrant will trade on NY stock exchange with VLN and VLNW tickers. Valens will begin trading at $1.1 billion market cap and the merger has produced $155 million of gross proceeds from the cash held in trust.

Sep. 29th: Israeli nanotech startup Gauzy (גאוזי) showcased a Light Control Glass (LCG), its smart glass technologies that allow internal and external vehicle glass to be an active material. The company, joined by partners Vision Systems, LG Display and Texas Instruments at the IAA Auto Show in Munich, showcased how its LCG with PDLC (polymer dispersed liquid crystal) and SPD (suspended particle device) allows internal and external vehicle glass to be an active material that supports full shading and glare mitigation, temperature control, infotainment, advertising, vehicle-to-vehicle and vehicle-to-pedestrian messaging. Gauzy technology is being used by Brose, Sekisui, and BMW, which has created a new headlight design for its BMWi Vision Circular Showcar, utilizing Gauzy SPD LCG Technology integrated into automotive thin glazed glass.

Sources: CTech, TechCrunch, BusinessWire, CISION PR Newswire, Calcalist, Globes, GlobeNewswire, The Fast Mode