- Stav Shvartz

- October 11, 2021

- 2:00 pm

- No Comments

China AV Newsletter | September 2021

DeepRoute and Momenta raised another USD 300 million each! While CoWaRobots follow with USD 250 million. The Virtual Driving System (VDS) companies are back on the front stage and while Baidu shared a report stating its dominance in the segment with the largest number of test licenses to date.

Sep.1st: Xiaomi announced the new automobile company’s completion of the industrial and commercial registration. The new company is called Xiaomi Automobile Co. Ltd., with a registered capital of CNY 10 billion (USD 1.55 billion). Lei Jun, Founder, Chairman and CEO of Xiaomi, serves as the legal representative. Lei Jun posted the news of completing the registration on his Weibo account and wrote: “School starts today for our fellows in Xiaomi Automobile!”

Sep.1st: HESAI signed an agreement with AIWAYS to collaborate on the implementation of automotive-grade LiDAR in mass production passenger cars. HESAI and AIWAYS will cooperate in hardware devices, software algorithms and intelligent driving assistance systems to help AIWAYS achieve a higher level of intelligent driving assistance systems.

Sep.1st: A ceremony was held to announce the construction of an intelligent driving industrial park and the “annual production capacity of 1 million sets of intelligent driving products construction project” jointly built by Wuzhen and Freetech. The project is located in the Wuzhen Big Data Industry Ecological Park in Tongxiang, Jiaxing City, Zhejiang Province, with a total construction area of 47,750 square meters. The project is mainly used for the development and production of new generation intelligent driving products such as millimeter wave radar, vision cameras and domain controllers to cope with the rapid development of the Chinese intelligent driving market and to help Freetech further strengthen its local R&D and production layout.

Sep.7th: Geely announced that it had officially signed a strategic investment agreement with ECARX, leading an investment of 4,321,521 shares in round B financing of ECARX, with an approximate amount of USD 50 million, providing Geely 1.51% of the total shares of ECARX. The two sides will work together to create an industry-leading ecological open platform for intelligent networking, so as to provide users with an improved intelligent and safer travel experience.

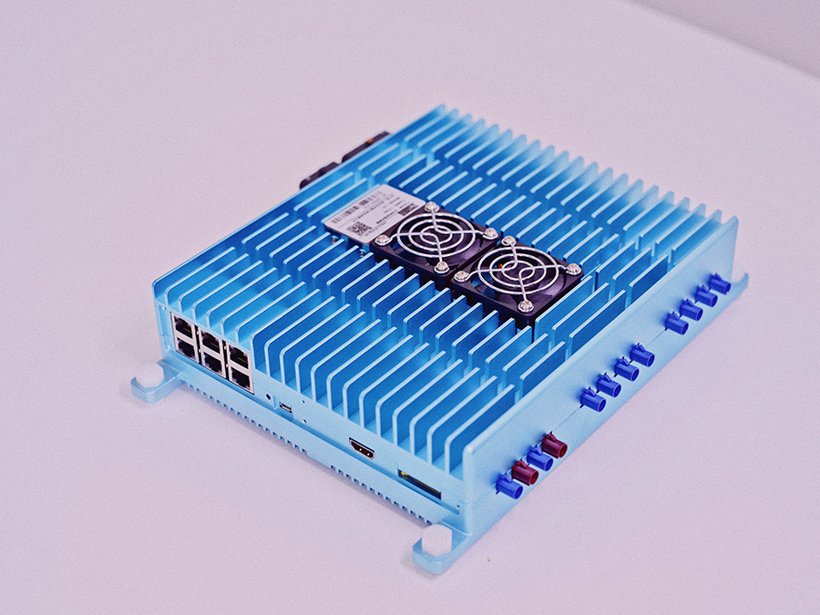

Sep.8th: In-Driving has completed another round financing, raising RMB 50 million (USD 7.8 million). This round of financing was invested by Xinyuan Microelectronics (Shanghai) Co., Ltd. and the funds will be mainly used to improve product computing power and chip R&D. Founded in 2014, In-Driving has long focused on R&D of autonomous driving algorithm and computing platforms. At present, its core products include Ares series of autonomous driving SOC module, Titan / Pallas series of a domain controller and Athena software system. In-Driving has now begun to deploy the R&D of domain controller chip, and is expected to deliver the national autonomous driving domain controller in the future.

Sep.9th: WeRide unveiled an L4 autonomous driving light bus, officially entering the crosstown freight sector. It will carry out strategic cooperation with Jiangling Motors and ZTO Express to jointly promote the front-mounted mass production and commercialization of RoboVan. WeRide’s RoboVan adopts the BEV model of Jiangling Light Bus with fully redundant chassis development and it’s equipped with WeRide’s full-stack software and hardware for autonomous driving solution, which can operate in urban traffic scenarios. WeRide has already completed 7 million km of tests in multiple cities around the world. This test foundation may be a guarantee for RoboVan to operate in rich and diverse urban traffic scenarios.

Sep.14th: HongjingDrive released a new generation of L3 autonomous driving heavy truck Hyper Truck One. According to Liu Feilong, the founder and CEO of HongjingDrive, the vehicle is jointly built by HongjingDrive and JAC, and will start mass-production in the first half of 2022. Hyper Truck One adopts HongjingDrive’s Windbreaker L3 system architecture 2.0, which is based on the integration of software and hardware, including HongjingDrive’s self-developed high-calculus autonomous driving computing platform, full-stack autonomous driving software algorithm, HMI for co-driving interaction platform and HongjingDrive’s data cloud platform, with complete independent intellectual property rights.

Sep.14th: DeepRoute.ai announced the completion of Series B financing, raising USD 300 million, led by Alibaba Group and followed by Jeneration Capital, Fosun RZ Capital, Yunqi Partners, and Glory Ventures. According to Zhou Guang, CEO of DeepRoute.ai, this round of financing will be mainly used for the company’s R&D investment, accelerating team expansion, and expanding the scale of its autonomous driving test and operation fleet.

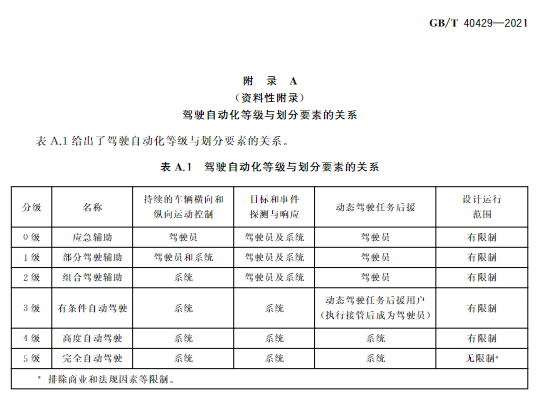

Sep.17th: The General Administration of Market Regulation has released a number of important national standards, including the official introduction of the National Recommended Standard for Auto Driving Automation Classification (GB/T 40429-2021) for autonomous driving functions, which is reported to be officially implemented on March 1, 2022, and will play a significant role in promoting the development of the autonomous driving sector and the development of subsequent related regulations.

Sep.23rd: Following Momenta‘s announcement on Sep. 16th that it has received additional investment from SAIC, General Motors also announced that it will invest USD 300 million in Momenta to accelerate the development of next-generation autonomous driving technology for future Chinese models. The agreement with Momenta will support GM’s efforts to accelerate the development and adoption of next-generation solutions tailored to Chinese consumers,” said Rick Berger, executive vice president of GM and president of GM China.

Sep.23rd: Trunk, an autonomous driving truck service provider, and LIDAR manufacturer HESAI have announced a strategic cooperation. Both parties will jointly work on R&D of high-level autonomous driving truck technology and will jointly explore AV applications in commercial scenarios such as smart ports and logistic services.

Sep.24th: iMotion, a provider of autonomous driving system solutions, announced that the company has recently completed a Series C financing round of several hundred million RMB. This round of financing was led by the National Mixed Reform Fund and followed by Huaqiang Venture Capital and Yongxin Ark. iMotion said that this round of financing will continue to be used to optimize the supply chain, promote mass production, R&D of new-generation product technology and autonomous driving team building.

Sep.29th: Baidu Apollo released the “2021 Baidu Robotaxi Service Semi-Annual Report“. According to the report, Baidu’s Robotaxi service continues to lead in covering the most cities, acquiring the most licenses and having the largest road network. The report shows that Baidu Apollo Robotaxi service has covered four cities, including Beijing, Guangzhou, Changsha and Cangzhou, with an operational coverage area of over 600 square km, over 410 test operation licenses, over 400,000 person-times of service, and 95.3% of five-star reviews of user experience.

Sep.29th: Autonomous driving company CoWaRobot has completed round C financing, raising USD 250 million, jointly invested by industrial capital and financial investors. Tao He, founder & CEO of CoWaRobot, explained that this round of financing will be mainly used to increase product development and underlying capacity building, further expand the domestic market, accelerate the empowerment of leading municipal sanitation industry companies, key regions for autonomous driving city distribution capacity services, and expand the scale of Robotaxi’s test fleet. Founded in 2015, CoWaRobot focuses on the development and application of autonomous driving and intelligent network connection technology in complex urban scenarios.

Sept.29th: Continental and Horizon Robotics have signed an agreement to establish a joint venture company to accelerate the commercial implementation of intelligent automotive technology. It is reported that the joint venture company is held by Continental and settled in Jiading District, Shanghai, with an estimated staff size of nearly 200 personal. Horizon’s chips and algorithms will be integrated into Continental’s line of smart cameras and scalable autonomous driving high-performance computers. Currently, several Chinese vehicle manufacturers have expressed interest in mass production cooperation.

Sources: Gasgoo; EqualOcean; Qbitai; Sohu;