- Stav Shvartz

- July 8, 2021

- 6:21 pm

- No Comments

China AV Newsletter | June 2021

The autonomous sector in China is boiling with advanced funding rounds and IPOs that exceeded several billion dollars investment in only one month! DiDi, one of the most valued startups in the world and the largest global ride-hailing platform completed its IPO, while Horizon Robotics shared its own IPO plans for later this year. The most interesting part for me is to see the long-term struggle of OEMs vs full stack VDS autonomous driving players. On one hand SAIC chairman announce he will not use external tech for AV in their vehicles as he doesn’t want to become only a hardware player, while on the other hand the tech VDS companies are planning to produce their own vehicles! Baidu production line with Geely was the first and now Pony.ai presented similar plans for vehicle production. Keep follow this NL and the latest developments.

Jun.3rd: Zongmu Technologies, an autonomous driving full-stack startup, has announced the completion of Series D funding round with a cumulative amount of USD 190 million. As a supplier of ADAS and Autonomous Driving technology and products, Zongmu has developed mass production application solutions. The company has become one of the first autonomous driving companies in China to be awarded contracts for L4 mass production projects by OEMs. Recently, Zongmu announced it has landed a contract by Meituan for its 4D millimeter wave radar for unmanned logistics cart project.

Jun.3rd: Chinese AI chip startup Horizon Robotics is considering an initial public offering (IPO) in the U.S. that could raise USD 1 billion. The earliest it could go public would be by the end of this year. Sources familiar with the matter said Horizon Robotics is preparing the stock offering with advisers and that the IPO deal location and timing are only preliminary information as the deal is still in the negotiation stage.

Jun.8th: HESAI announced the completion of a Series D round of funding more than USD 300 million, led by High Tide Ventures, Xiaomi Group and Meituan. The funding round will be used to support the mass production delivery of hybrid solid-state LIDAR for front-end mass production (which has already received multiple OEM orders) and the development of automotive-grade high-performance LIDAR chips.

Jun.10th: At the site of the 2021 Global Intelligent Logistics Summit, Alibaba CTO and CTO of Cainiao, Cheng Li, revealed that Alibaba is developing autonomous driving logistic pods “Little Donkey”, and that Damo and Cainiao have launched an open road unmanned logistics pod definitions and research project. This means that Alibaba is moving from low-speed to high-speed operation and from semi-closed zone scenarios to open-roads, storming on the path to full autonomy.

Jun.11th: DiDi has officially filed its IPO prospectus with the SEC under the symbol “DIDI”, with Goldman Sachs, Morgan Stanley and JP Morgan Chase as underwriters. In the prospectus, DiDi disclosed that it plans to use approximately 30% of the proceeds to expand its business in international markets outside of China and approximately 30% of the proceeds to enhance its technology capabilities, including shared mobility, electric vehicles and autonomous driving.

Jun.11th: Pony.ai has set its eyes on car production and the company has confirmed the establishment of a 10-member team in Shanghai. People familiar with the matter believe that Pony.ai’s car-making plan may be related to its IPO plan. The firm is planning to go public through a SPAC. It is reported that the post-IPO valuation of Pony.ai is expected to reach USD 10 billion.

Jun.16th: Pony.ai plans to launch autonomous driving taxi service in California in 2022. The company has revealed that its autonomous driving vehicles are currently being tested on public roads in Fremont and Milpitas, California. Pony.ai says it aims to start offering fully driverless taxi services to the public by 2022. The company’s co-founder and CEO Peng Jun said, “Full driverless is the key catalyst for our ambitious vision.”

Jun.18th: SenseTime is considering an initial public offering of approximately US$2 billion in Hong Kong by the end of this year, with CICC as its confirmed sponsor, and will submit its listing application to the Hong Kong Stock Exchange as early as August.

Jun.20th: Beijing ZVision has announced the completion of Series B financing round of several hundred million RMB, led by Intel Capital and Innovation Works. Up till now, the company has completed a total of five rounds of financing. Founded in 2017, ZVision pioneer in the development of domestic automotive-grade MEMS LIDAR. Since its establishment, it presented a variety of MEMS LIDAR solutions covering long, medium and short range applications, among which, the short-range ML-30s has been introduced in mass production in 2020.

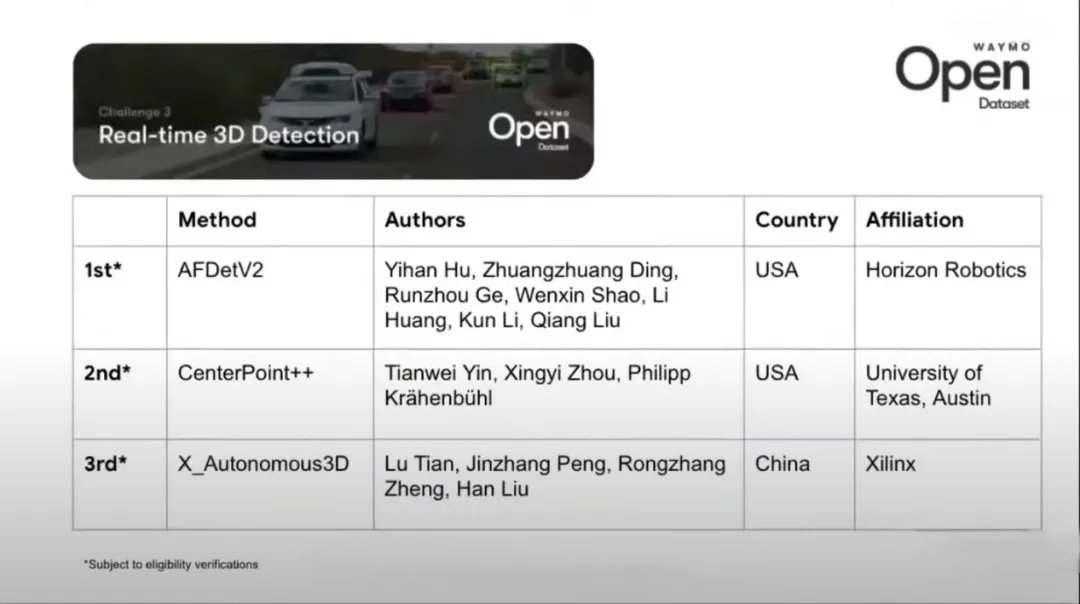

June.20th: The CVPR 2021 Autonomous Driving Symposium announced the final result of this year’s Waymo Open Data Set Challenge, with Horizon Robotics team taking first place in the Real-Time 3D Inspection category with its AFDetV2 model and the AFDetV2-Base model being named the Most Efficient Models. Waymo opened to the competitors over 10 million miles and 570 hours of autonomous driving road data collected by its autonomous driving vehicles in 25 different cities, with over 100,000 real-life urban scenarios. The competition attracted over 30 top institutions, both academic and commercial autonomous driving R&D teams including: Tsinghua University, DiDi, Berkeley, University of Texas, Nanyang Technological University and others.

June.22nd: Amazon has reportedly placed an order for 1,000 autonomous driving systems from Chinese autonomous driving startup Plus.ai for USD 150 million. According to Bloomberg, a regulatory filing for Plus.ai shows that Amazon has also acquired a 20% stake in the company. Amazon will now have the right to acquire shares at a price of about 46 cents per share, which would give Amazon a 20% stake based on the shares outstanding prior to the merger of Plus.ai with special purpose acquisition firm Hennessy Capital Investment Corp.

June.23rd: WeRide announced a strategic investment from Renault-Nissan-Mitsubishi Alliance fund, with a total funding of USD 310 million. In the past five months, WeRide completed a total funding round of over USD 600 million, with a post-investment valuation of USD 3.3 billion. Ashwani Gupta, COO of Nissan, said, “China is at the forefront of defining the future of mobility and we are excited to partner with WeRide to bring more innovative technologies and services to enrich the lives of the Chinese people.”

June.30th: During SAIC Motor’s shareholders meeting, an investor asked whether SAIC would consider cooperating with third-party companies such as Huawei in autonomous driving applications. In response, SAIC Chairman Chen Hong said that “it would be unacceptable for SAIC to cooperate with a third-party for autonomous driving. In this way, Huawei becomes the soul and SAIC becomes the body. SAIC wants to keep the soul in its own hands”.

June.30th: DiDi officially landed on the U.S. stock market under the code “DIDI”, offering 317 million ADS at the upper limit of $14 raising at least $4.4 billion, which represent 10% increase compared to the previous plan for 288 million shares. The opening price was $16.65, nearly 19% higher than the offering price. Shares rose to a high of $18.01 during the day, up 28.6%, before narrowing slightly to close at $14.14, up 1% on the first day. By the close of trading, DiDi’s market-cap was USD 67.8 billion (RMB 438 billion).

Sources: Gasgoo; Techweb; EqualOcean.